A growing number of retirement planning experts are joining the chorus of people saying 401(k) plans no longer make sense for savers in recent articles on Motley Fool, Bloomberg, MarketWatch, and other major publications.

They’re lamenting that one of the biggest appeals of the 401(k) – the ability to make contributions with untaxed dollars in exchange for tax-deferred growth and withdrawals – is disappearing.

The national debt was already skyrocketing before the pandemic spurred the biggest fiscal stimulus programs in history. And a surge in unemployment has lowered tax revenue for federal and state governments.

What do governments typically do to counter budget deficits?

They raise taxes, of course!

And as taxes rise, deferring them in a 401(k) or IRA means you’ll pay more later – potentially a lot more.

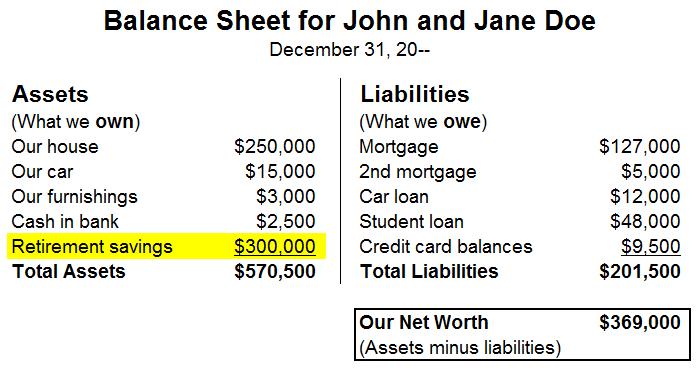

Even before the pandemic, the Center for Retirement Research said people lose 25%-33% of the value of their 401(k) to taxes… and most people are shocked when it happens because they forget they’ll owe the IRS taxes on every penny they’ve put in and every penny of growth they’ve deferred.

Do you know what the tax rates will be in 20 or 30 years from now? For that matter, do you know what they’ll be next year or in two years?

[Read more…] “Why More Experts Are Now Saying It’s Time to Ditch Your 401(k)”