The Bank On Yourself method relies on a specially designed high cash value, low-commission, dividend-paying whole life insurance policy. But are those mysterious riders (or options) that are added, which grow your cash value significantly faster than the whole life policies most financial experts talk about?

With these riders in place, you’ll have equity (“cash value”) in your policy in the very first month. And you can potentially use that equity as a powerful financial management tool right from the start. (For the record, the policies that financial advisors love to hate do not pay dividends and typically have no cash value at all in the first year.)

So, let’s take a peek under the hood and see precisely what those riders are and how they make your cash value grow so much faster.

A key goal of the Bank On Yourself strategy is to maximize the growth of your cash value without increasing your premium. The cash value is the storehouse of money you can use to bypass banks, credit cards, and finance companies to become your own source of financing. Use that money wisely, and you might eventually be able to finance most or all of your lifestyle from it!

First, let’s define some key terms:

Whole life insurance is permanent, or cash value, life insurance that provides benefits for the whole of your life (versus term insurance, which only lasts for a specific period). The cash value increases every year by a guaranteed and preset amount specified in the contract. The cash value is guaranteed to equal the policy’s death benefit in a specific future year, the maturity date.

Mutual vs. stock insurance companies: In a company owned by stockholders (a stock company), the stockholders receive the company’s profits. But if your company is owned by the policy owners (a mutual company, also known as a participating company), guess who shares in the profits? You do! These profits are given in the form of dividends. Each year, the company does an accounting of its income and expenses. The directors may declare a dividend if it performs better than its worst-case projection. Although dividends are not guaranteed, some participating companies have consistently paid dividends every year for over 100 years, including during the Great Depression. These are the companies Bank On Yourself Professionals recommend.

Properly designed, your Bank On Yourself policy can grow both your cash value and death benefit faster than a traditional whole life policy.

Secrets of Optimized Policy Design: Base + PUAR + Term Rider

The Base Policy: This is your basic no-frills dividend-paying whole life policy. You want a dividend-paying whole life policy issued by a financially strong company with an unblemished history of paying dividends for 100 years or more.

Bank On Yourself Professionals are trained on the proper way to add riders or options to the base policy to maximize your cash value more quickly and provide you with a bigger death benefit over time.

The Paid-Up Additions Rider (PUAR): This rider is the most efficient way to build cash value because it channels most of your premium directly into the cash value portion of the policy while still purchasing a small death benefit. Paid-up additions are essentially mini-life insurance policies that require a one-time-only premium.

The Term Insurance Rider: Adding this rider increases your death benefit, so your policy can hold even more cash value than it otherwise could. While I’m not a big fan of term insurance as a long-term strategy, read on to learn more about how adding a term rider to your policy benefits you.

Comparing a “No-Frills” Whole Life Policy Performance with a Supercharged Bank On Yourself Policy

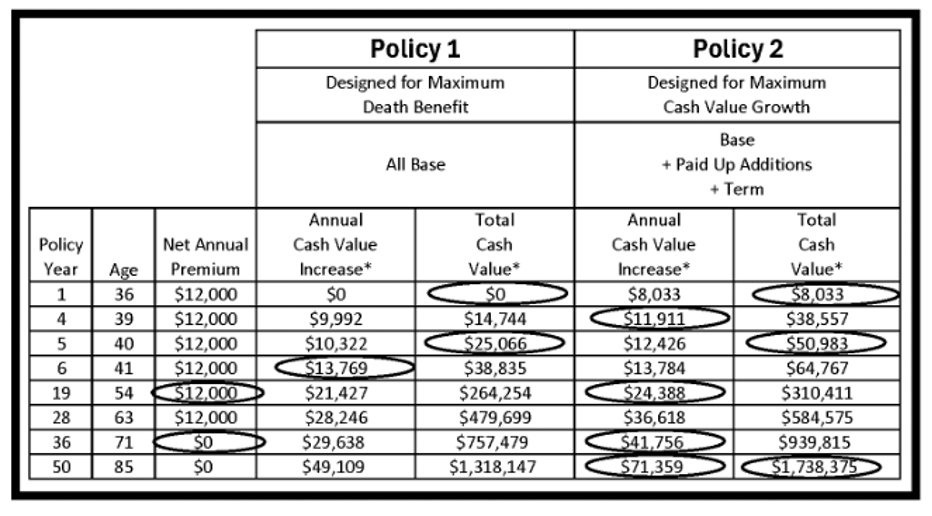

Table A compares two dividend-paying whole life insurance policies designed for the same hypothetical thirty-five-year-old healthy man, whom we’ll call Martin. Martin’s annual premium in each policy is $12,000; however, how the premium is allocated varies. (Don’t get hung up on this specific premium. It’s just an example. Your policy would be custom-tailored to your unique situation, so you start at whatever level works for you. Policies can be designed for newborns and folks up to age eighty-five.)

Table A: Cash Value Growth

Policy 1: All Base

Policy 1 is a traditional dividend-paying whole life insurance policy. All the premiums go to the base policy, and no riders are added. Many agents focus only on the death benefit, so they choose a policy structured for maximum death benefit with the lowest premium possible. That sounds reasonable, but it doesn’t work out very well if you also want to enjoy the most living benefits of a policy.

In Policy Year 6, Martin’s $13,769 cash value increase exceeds his $12,000 premium.

Policy 2: Base + Paid-Up Additions Rider + Term Rider

In Policy 2, only 30% of Martin’s premium is used to pay for the base policy and a term insurance rider. The remainder purchases Paid-Up Additions (PUAR). These additions accelerate the growth of his cash value while providing a smaller death benefit.

Well over 90% of every PUAR premium dollar goes directly to building cash value, very little goes to the cost of the death benefit, and only a minuscule amount goes to the agent as a commission.

Notice how much more cash value Policy 2 has than Policy 1 every year—including twice as much in Year 5.

The premium you pay into your PUAR is optional. You don’t need to pay it to keep the policy in force. So, in a pinch, you can cut back on it, and some companies will even let you catch up on some or all of it later, as your situation allows. That gives you greater flexibility than a traditional no-frills whole life policy has.

Why add a term rider to a whole-life policy? We’ve discussed how term insurance isn’t a good substitute for permanent life insurance. However, term coverage has a valuable place as a rider to a permanent policy. Here, the term rider allows you to pay more into your PUAR and thus build cash value faster—without running afoul of IRS guidelines.

The IRS limits the percentage of premium that can be channeled into the cash value rather than the death benefit. If the policy exceeds this limit, it becomes a modified endowment contract (MEC) and loses a key tax advantage. The limit is based on a complicated formula, but the higher the death benefit, the more money can be channeled into the cash value.

The term rider increases the death benefit. So, the IRS formula allows Martin to plow more money into his cash value without losing a key tax advantage. The term rider is generally designed to be jettisoned in the twentieth policy year.

Now let’s look at how these two policies could play out for Martin:

Highlights: Cash Value Comparison (Table A)

- Look at the Total Cash Value for Policy Year 1. Although both policies had identical premiums, Policy 1—which is Designed for Maximum Death Benefit—had zero cash value (and also had zero cash value at the end of Year 2!), whereas Policy 2—which has both a Paid-Up Additions Rider and a term rider—had over 2/3 of its premium in cash value ($8,033) at the end of the very first year.

- The annual cash value increase in Policy 2 about equaled the annual premium in Year 4 versus Year 6 for Policy 1.

- In Year 19, in Policy 2, the cash value increased by more than twice the premium paid.

- And beginning in Year 28, Policy 2’s cash value increased by more than three times the annual premium.

- Finally, in Policy 2, Year 35 was the last year any premiums were paid out-of-pocket (dividends were surrendered to pay them). But the cash value continued to grow every year—no luck, skill, or guesswork required. For example, in Year 50, the premium paid was zero, but the cash value grew by $71,359.

Your Reward for Patience

As I’ve stressed, these policies are not get-rich-quick magic pills. Even with the supercharged variations used for the Bank On Yourself concept, it takes a while for your cash value to equal the premiums you paid. Of course, from day one, your premiums will immediately provide you with your policy’s death benefit and the peace of mind this brings. Your reward for patience is the steeper growth curve every year you have the policy.

And keep in mind, as soon as your guaranteed annual cash value increases and any dividends are credited, they’re locked in. You don’t go backward. The cash value of a whole life policy does not decline due to market fluctuations, and it is not subject to the volatility of the stock or real estate markets.

That’s why I believe Bank On Yourself may be the ultimate financial security blanket in both good times and bad. Imagine looking forward to opening your policy statements because they always have good news and never have ugly surprises!

Each policy is custom-tailored – there are no cookie-cutter programs – so yours won’t look like Martin’s. To find out what a policy designed for your unique situation, goals, and dreams can look like, request a FREE Analysis. When you do, you’ll get a referral to one of the Professionals.

REQUEST YOURFREE ANALYSIS!

More Cash Value Plus More Death Benefit?

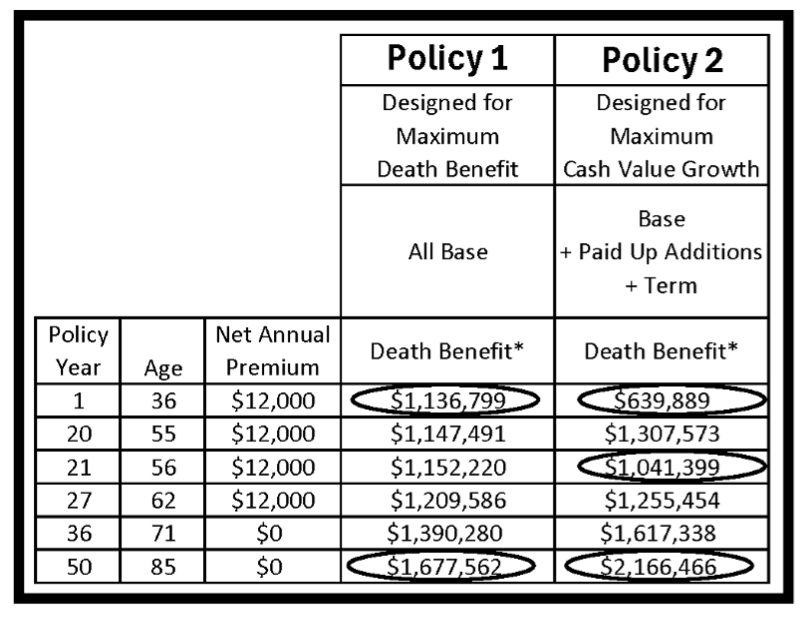

What happens to the death benefit if we keep the premium at $12,000 per year and use much of that premium to grow the cash value faster? Check out Table B and see.

Highlights: Death Benefit Comparison (Table B)

- Although both policies had identical premiums and built solid death benefits, Policy 2 built the largest death benefit over time.

- In Year 35, the out-of-pocket premiums stopped, and dividends were surrendered to pay them. However, both the death benefit and the cash value continued to grow each year.

- By Year 50, the death benefit in Policy 2 grew by $549,128 in the 15 years since out-of-pocket premiums stopped being paid.

- If the insured passed away at age 85, Policy 2 provides a legacy of $2,166,466 for his family or favorite charities. That gift can pass income tax-free under current tax law without going through the probate process.

Note Policy 2 in Year 20. The death benefit drops from $1,307,573 to $1,041,399 the following year. Huh? That’s when the term rider was jettisoned. The premium that was allocated towards the term rider may now be used to purchase additional Paid-Up Additions. So now, Martin’s policy is positioned for maximum cash value growth, and the death benefit in Policy 2 is growing even faster than in Policy 1. In fact, by Year 27, Martin’s death benefit in Policy 2 exceeds the death benefit of Policy 1.

Recall from Table A that Policy 2 also has more cash value than Policy 1. So, Policy 2, designed the “Bank On Yourself way,” ended up with more cash value and death benefit. That’s what an optimized policy design can do for you!

Table B: Death Benefit Growth

Bank On Yourself Professionals are trained to build the best structure for your policy and coach you to use the policy in the most effective ways. If you’re considering someone else, make sure they understand how to structure a policy to your benefit, even though it will reduce their commission by 50% or more.

REQUEST YOUR

FREE ANALYSIS!

_____________________

* Annual Cash Value Increase, Total Cash Value, and Death Benefits are based on the dividend scale as of December 2024. Dividends can change and are not guaranteed; however, the companies generally recommended by Bank On Yourself Professionals have consistently paid dividends every year for over 100 years. Policies from different companies may vary.