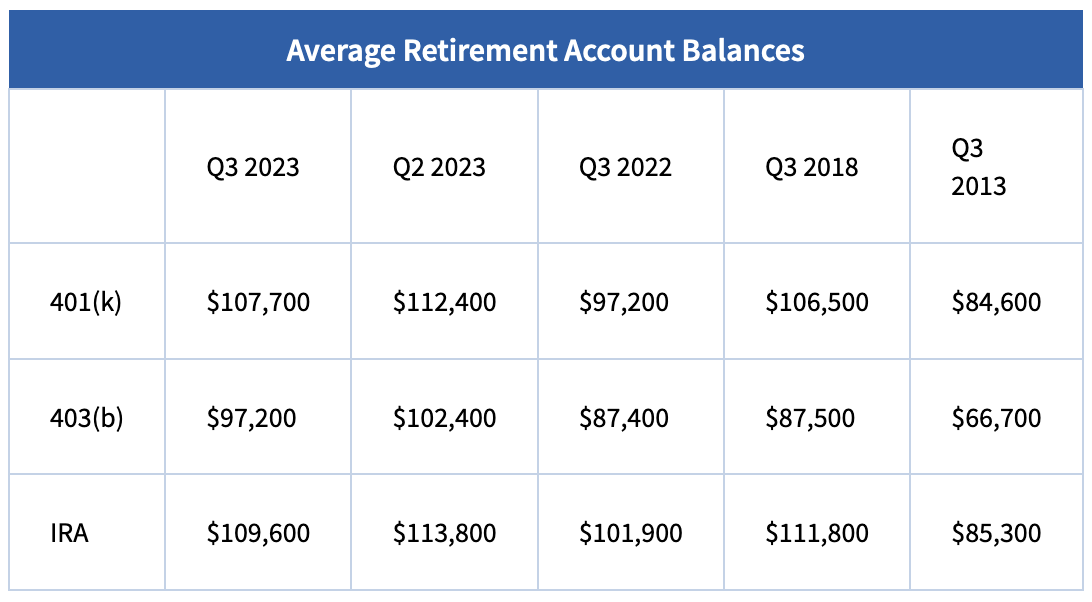

Fidelity Investments, the largest provider of 401(k) plans, just reported that the average 401(k) account balance barely budged in the 5 years since the 3rd quarter of 2018. They increased by only $1,200 from $106,500 to $107,700… less than 1.2% total.

To make matters worse, inflation was a whopping 21% during the same period. (Here’s a great inflation calculator.) That means those average 401(k) accounts needed to be at nearly $129,000 – just to keep up with inflation!

Okay, but what if you waited longer, say 10 years, like the “experts” say you should. On the surface, that looks better. The average 401(k) was $84,600 10 years ago and is now $107,700 (a 27.3% gain). But inflation over that period was 30.45%, so the average 401(k) would have to be at $110,357 today to keep up with inflation.

In 2022, the average 401(k) balance plunged 22.9%, according to Fidelity Investments. As I write, the market has been rallying, but you’d need an increase of almost 30% to get back to where you were… and another 3.5% increase to keep even with inflation in 2023, let alone have a gain. It’s pretty nasty news if 2022 was the year you had planned to retire.

And the typical IRA hasn’t fared any better over the last ten years, according to Fidelity:

What if you looked at an even longer time horizon, say the past 30 years?

Here’s the Harsh Reality of the Actual 30-Year Returns Investors Are Getting…

Are you sitting down? This will floor you: According to the 2023 DALBAR study, the typical investor in equity mutual funds has gotten only a 4.3% annual return – after adjusting for inflation – for the past 30 years that ended December 31st!

Oops!! A 4.3% Real Average Annual Return for the Last 30 Years?!?

Was that worth the stomach-churning roller coaster ups and downs, and sleepless nights?

Shockingly, the typical asset allocation investor had essentially no growth over the last 30 years after taking inflation into account. And fixed income investors lost ground even before factoring in inflation.

Even worse, the report did not account for the taxes you’ll owe the IRS on your withdrawals if you’ve been saving in a tax-deferred account like a 401(k), 403(b) or IRA. And that will devour at least 25%-33% of your savings, according to the Center for Retirement Research at Boston College.

That assumes tax rates don’t go up over the 20 to 30+ years of your retirement. (And if you believe tax rates won’t increase over the long term, I’ve got a Rolex watch I’ll sell you for $10.)

Isn’t the Classic Definition of Insanity to Continue Doing What Clearly Hasn’t Worked for the Last Three Decades?

This is a HUGE part of why the typical household nearing retirement has an average of only $185,000 in their combined retirement accounts, which will provide only $800 per month income, according to the 2023 Federal Reserve Survey of Consumer Finances.

Wall Street’s BIG Lie is that You Must Risk Your Money to Grow It

The Bank On Yourself safe wealth-building strategy puts that lie to rest. It’s a supercharged variation of an asset that’s grown in value every single year for more than 160 years, including during every global pandemic, the Great Recession, and the Great Depression. It comes with an unbeatable combination of advantages and guarantees, including:

-

Your money is guaranteed to grow by a larger dollar amount every year, giving you built-in protection from inflation

You can even know how much money you’d have at any point – guaranteed – before you decide if you want to move forward with this strategy. Just request a FREE, no-obligation Analysis here to find out:

FREE ANALYSIS!

- Both your principal and growth are locked in, and don’t go backward when the market tumbles

- You enjoy growth that’s significantly greater than you could get in a CD or money market account, but without taking on greater risk to do it

- You have complete control of and access to your equity in the plan to use however and whenever you choose, so you can weather the challenges life unexpectedly throws at you (try doing that with your 401(k) or IRA!)

- You can access both your principal and growth with ZERO taxes due(!) under current tax law, which lets you avoid unpleasant tax surprises later

- You can use your money in the plan to eliminate banks and finance companies from your life and become your own source of financing

- And much more

To see how adding the Bank On Yourself strategy to your financial plan could help you reach your financial goals without taking any unnecessary risks, request your free Analysis here now.

There’s no cost or obligation, and you’ll get a referral to a Bank On Yourself Professional who can answer any questions you may still have.

Keep in mind that the only regret most people say they have about implementing the Bank On Yourself strategy is that they didn’t start sooner.

So don’t put it off another day – request your free Analysis NOW to enjoy more financial security and control in the New Year:

REQUEST YOURFREE ANALYSIS!

Speak Your Mind