UPDATED October 2019

I came across an online article by a blogger who ignorantly claimed that the only good purpose for whole life insurance was as a rich man’s Roth and only for individuals whose high incomes made them ineligible for the tax-saving advantages of a Roth IRA. He’s dead wrong — you don’t have to be wealthy to benefit from the incredible advantages of whole life insurance.

Let’s look at how a Roth IRA works vs. a dividend-paying whole life insurance policy.

How Does a Roth IRA Work?

A Roth Individual Retirement Arrangement (Roth IRA) is an IRS-approved strategy that allows you to invest money you have earned by making contributions to a Roth IRA plan you have set up. You are not allowed to take a tax deduction for your contribution as you are with a traditional IRA. However, any earnings you withdraw from a Roth IRA aren’t taxed — as long as you’re at least age 59 1/2 and you’ve had the Roth IRA for at least 5 years.

How a Roth IRA differs from a traditional IRA

Roth IRAs are quite different from traditional IRAs.

With a traditional IRA, your contributions are tax-deductible. However, when you withdraw money from your traditional IRA—and you must withdraw specific percentages annually, beginning soon after your seventieth birthday—you must pay taxes on everything you withdraw—at whatever the tax rate happens to be at the time.

See the table for a summary of the key differences between a Traditional IRA and a Roth IRA.

| Type of IRA | Are contributions tax-deductible? | How are withdrawals taxed? | Must you take Required Minimum Distributions? |

| Traditional IRA | Yes | Everything you withdraw is taxable* | Yes, beginning at age 72 |

| Roth IRA | No | Nothing you withdraw is taxable* | No, not under current tax law |

| * Assuming you comply with all government regulations concerning the amount and timing of your withdrawals | |||

Roth IRAs—like all IRAs—have many rules and restrictions

Roth IRAs, like traditional IRAs, come with many government regulations, including limits on contributions.

There are other rules, too: When you can withdraw from your Roth IRA without penalty (that depends on a number of factors), whether or not you can borrow from your Roth (you cannot), limits on the “kind” of money you may contribute (only earned income) and so forth.

Some financial representatives will say, “Hey, if you can’t contribute what you want to your Roth, put your money in whole life insurance — it’s the Rich Man’s Roth IRA.”

The problem is, they’re portraying life insurance as a second choice. People who fully understand the benefits of a supercharged whole life insurance policy realize a high early cash value whole life insurance policy should be your first choice—regardless of how “rich” you are!

How Whole Life Insurance Is Better Than a Roth IRA

This anonymous blogger appears to be a financial representative, based on his reference to his “clients.” But if he is a financial representative, he is shockingly ignorant about some critical life insurance basics.

For example, he says, “Whole life insurance is also known as permanent or universal life insurance.”

Whoa! There are two broad types of life insurance: term and permanent. There are three very, very different kinds of permanent life insurance: Whole life, universal life, and variable life.

If you say that whole life insurance is also known as universal life insurance, you clearly know little or nothing about life insurance.

Here’s one very important way whole life insurance and universal life insurance are not the same:

Both whole life insurance policies and universal life insurance policies contain a “cash value” component—that part of the insurance policy where wealth grows. But with a whole life policy, that growth is guaranteed, based on a schedule that is set in stone—and augmented, in some policies, by dividends (which are not guaranteed).

On the other hand, with a universal life policy—even guaranteed universal life—growth of your cash value is not guaranteed.

Because our less-than-well-informed blogger doesn’t understand that the cash value growth of a whole life insurance policy is guaranteed—he makes uninformed statements like:

-

“Every scenario I have ever encountered where an individual has been paying on a whole life policy for an extended number of years, what they were told they would have accumulated by that point has never been even close to what they actually have.”

That’s true for universal life, but not true for whole life insurance. In fact, the opposite is true: Because of the non-guaranteed dividends of some whole life policies, those policy owners virtually always have more—usually, significantly more—than they were guaranteed they would have. In fact, many dividend-paying whole life companies have an uninterrupted track record of paying dividends for more than 100 years!

-

“Illustrations of potential cash value offered by agents are so often unrealistic.”

Again, true for universal life, but not true for whole life. Whole life cash value growth (not including dividends) is absolutely guaranteed—in writing. All fifty states regularly audit the whole life insurance companies doing business in their state to ensure that the companies have the reserves to back up their guarantees.

Furthermore, by law, whole life insurance policy illustrations must show projections based on that guaranteed growth. They are also permitted to show the growth you would have if, over the life of the policy, the company paid dividends no higher than they are currently paying.

-

“A whole life policy that is supposed to make you rich in retirement is a terrible idea. You’ll simply be sending good money into the ether and not necessarily seeing the return you could get with other investments.”

The poor guy’s talking about universal life and doesn’t even know it. While it’s true that with whole life insurance, you’re not seeing the gains you might get with other investments, you’re not seeing any of the losses, either. For that and other reasons, whole life insurance, a/k/a the Rich Man’s Roth, can be a very good investment alternative.

Get instant access to our FREE 18-page Special Report, 5 Simple Steps to Bypass Wall Street, Fire Your Banker, and Take Control of Your Financial Future, plus a FREE chapter from Pamela Yellen's New York Times best-selling book on the concept.

Get instant access to our FREE 18-page Special Report, 5 Simple Steps to Bypass Wall Street, Fire Your Banker, and Take Control of Your Financial Future, plus a FREE chapter from Pamela Yellen's New York Times best-selling book on the concept.

Our friend confuses stock market returns and whole life insurance growth

This blogger says, “If you’re putting money into a whole life policy in the hope that it will mean smooth sailing in your retirement years, then you are wasting your money.”

That’s backwards!

If you’re putting money into the Wall Street Casino in the hopes that it will mean smooth sailing in your retirement years, it means you weren’t paying attention to what the market has done since the year 2000: two crashes of about 50% or more!

Competitive growth, safety, freedom from most government regulation, and the fabulous tax advantages of whole life insurance make it the smart option, hands down.

Wall Street is a sucker’s bet.

The Importance of Good Whole Life Insurance Policy Design

Mary has a sensible 178-horsepower Kia. Larry has an outrageous 650-horsepower Corvette.

If you want to win a drag race, which car should you drive?

Would you say, “It doesn’t really matter. A car is a car is a car?”

Of course not!

And you shouldn’t think for a moment that all whole life insurance policies are the same, either. A book could be written on the ideal whole life insurance policy—one that combines reasonable cost with superlative cash value growth capabilities, and an increasing death benefit.

I wrote that book. It’s my second New York Times best-seller, The Bank On Yourself Revolution. If you don’t have my book, get my free Special Report on the subject here, which comes with a free chapter from my book.

This blogger doesn’t understand the plain, simple facts about whole life insurance!

Just look at how this anonymous blogger messes with the truth:

Blogger: “This whole life enthusiast wants me to wait 35 years until I start seeing my cash value accrue.”

The Reality: Gosh, is he really saying that with whole life insurance you’ll have little if any cash value for the first 35 years?

As you can plainly see on my website, you can have a whole life insurance policy with solid growth beginning in Year 1!

Our blogger’s 35-year-old male can see cash value in the very first year—and reasonably expect that by year eight or nine, his cash value grows by more than his annual premium, year after year, after year.

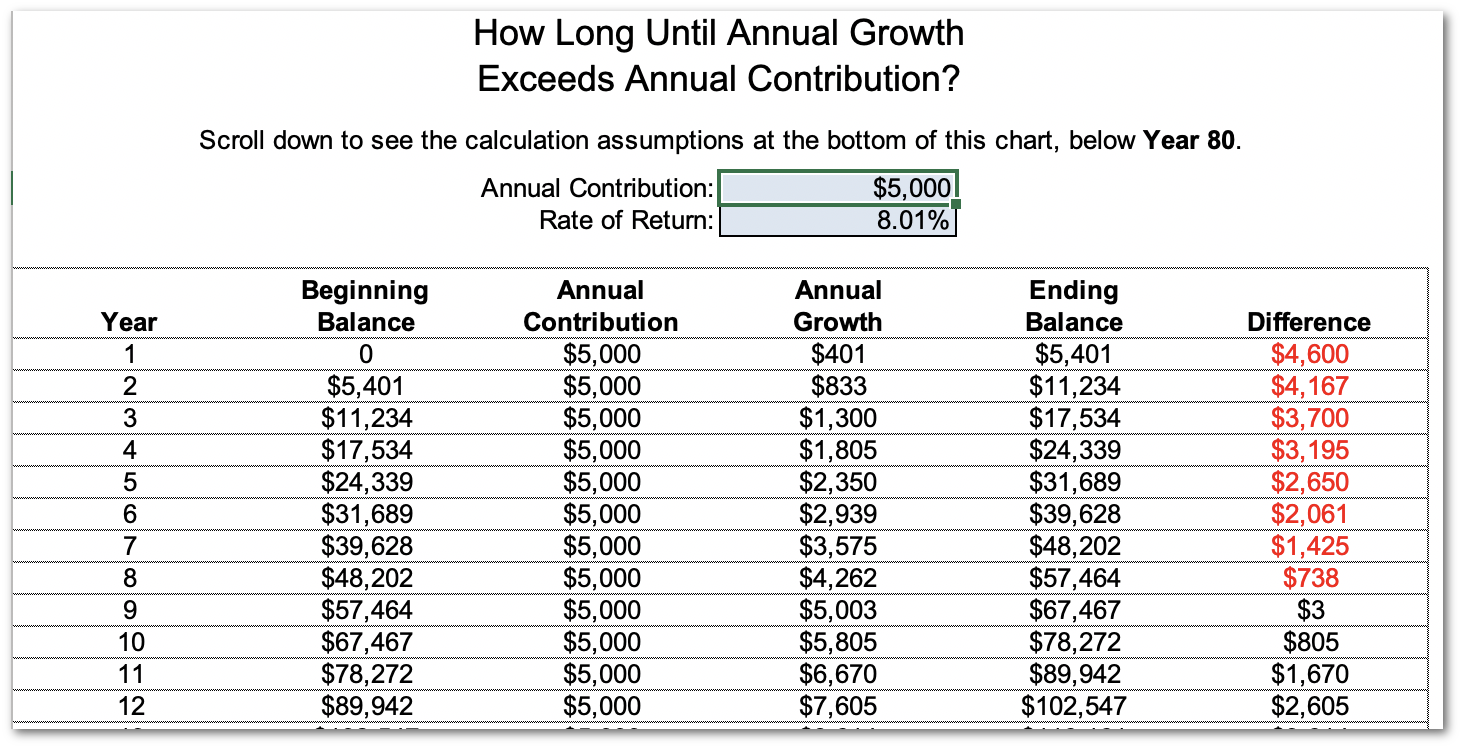

To get that kind of return with any other financial product, you’d need an annual return of more than 8% every single year. Are you skeptical of that? Here’s a spreadsheet you can download that demonstrates how it takes an annual return (after any fees) of more than 8% for your annual growth to exceed your annual contribution by year nine—something this high early cash value, dividend-paying whole life insurance policy does.

- Download the spreadsheet, then enter any amount you wish in the light blue Annual Contribution box.

- Choose an Annual Rate of Return and enter that amount in the Rate of Return box.

- Look in the right column, Difference. The first black (positive) number is the first year your annual growth exceeds your annual contribution. The far left column, Year, tells you which year that is.

Blogger: “Commissions for whole life policies can start at 55 percent of the first year’s premiums and can be as high as 100 percent.”

The Reality: He needs my book. He’ll see how the type of whole life insurance policies recommended by Bank On Yourself Professionals cut the financial representative’s commission by 50-75%—leaving the rep with just a small portion of the typical whole life insurance commission.

Blogger: One “aspect of whole life insurance that makes personal finance experts twitchy is that illustrations of potential cash value offered by agents are so often unrealistic.”

The Reality: Wrong, wrong, wrong! Learn the difference between universal and variable life insurance on the one hand, and dividend-paying whole life insurance on the other hand.

Why the “buy term and invest difference” claptrap makes me shake my head in bewilderment …

Blogger: “Whole life is dangerous because it is so expensive. It soaks up so much of your cash. You may not have enough money to buy all the coverage you really need. As a result, many people go terribly underinsured, and it’s the family that pays the price. … Most earners should purchase a sufficient term life policy and a modest permanent life insurance policy.”

The Reality: That’s pretty amazing. After bashing permanent life insurance—even calling it “dangerous”—he says most earners should have some!

Blogger: “Many financial experts recommend that people … buy term insurance and invest the difference between the term premiums and the whole life premiums.

Get instant access to our FREE 18-page Special Report, 5 Simple Steps to Bypass Wall Street, Fire Your Banker, and Take Control of Your Financial Future, plus a FREE chapter from Pamela Yellen's New York Times best-selling book on the concept.

The Reality: Don’t get me started! Let’s say his 35-year-old male buys a 30-year term policy and invests the difference between the term policy’s premium and what he would pay for a Bank On Yourself-type policy.

Sure, in the early years, he could—in theory— be investing the difference. But before too many years have passed, he will be selling off his investments to fund his high term policy premiums. That’s because term insurance starts out cheap but ends up extremely expensive.

Over 50 years, he could save about $30,836 in premiums by getting a Bank On Yourself-type policy, instead of buying term insurance.

Besides, “People don’t buy term and invest the difference,” said David F. Babbel, professor at the Wharton School of the University of Pennsylvania and co-author of “Buy Term and Invest the Difference Revisited,” published in the May 2015 issue of Journal of Financial Service Professionals. Babbel added:

They most likely rent the term, lapse it and spend the difference.”

The Best Alternative to a Roth IRA is a Properly Structured Whole Life Insurance Policy

You can get all these advantages – whether you’re rich or not:

- You can access your principal and growth, with no taxes due under current tax law

- Immediate cash value, with growth that gets better every year

- Premiums that never increase—even when you’re 100 years old (imagine a term life insurance policy offering that!)

- A death benefit that grows over time and is income tax-free to your heirs

- Flexibility and no government restrictions or penalties, compared to Roth IRAs

Get all the advantages of whole life insurance, a/k/a the “Rich Man’s Roth” – whether you’re rich or not!

To find out more, request a FREE Analysis and Personalized Recommendations—customized to your specific situation.

When you request a FREE Analysis, you’ll discover:

- The guaranteed minimum value of your plan on the day you plan to tap into it … and at every point along the way

- How much income you can count on having during your retirement years

- How much you could increase your lifetime wealth—just by using a Bank On Yourself plan to pay for major purchases, rather than by financing, leasing, or directly paying cash for them

- How you can achieve your short-term and long-term financial goals in the shortest time possible

- Answers to other questions you may have

Get started today! Request your FREE Analysis here now, while it’s fresh in your mind!

Speak Your Mind